How to design trading system

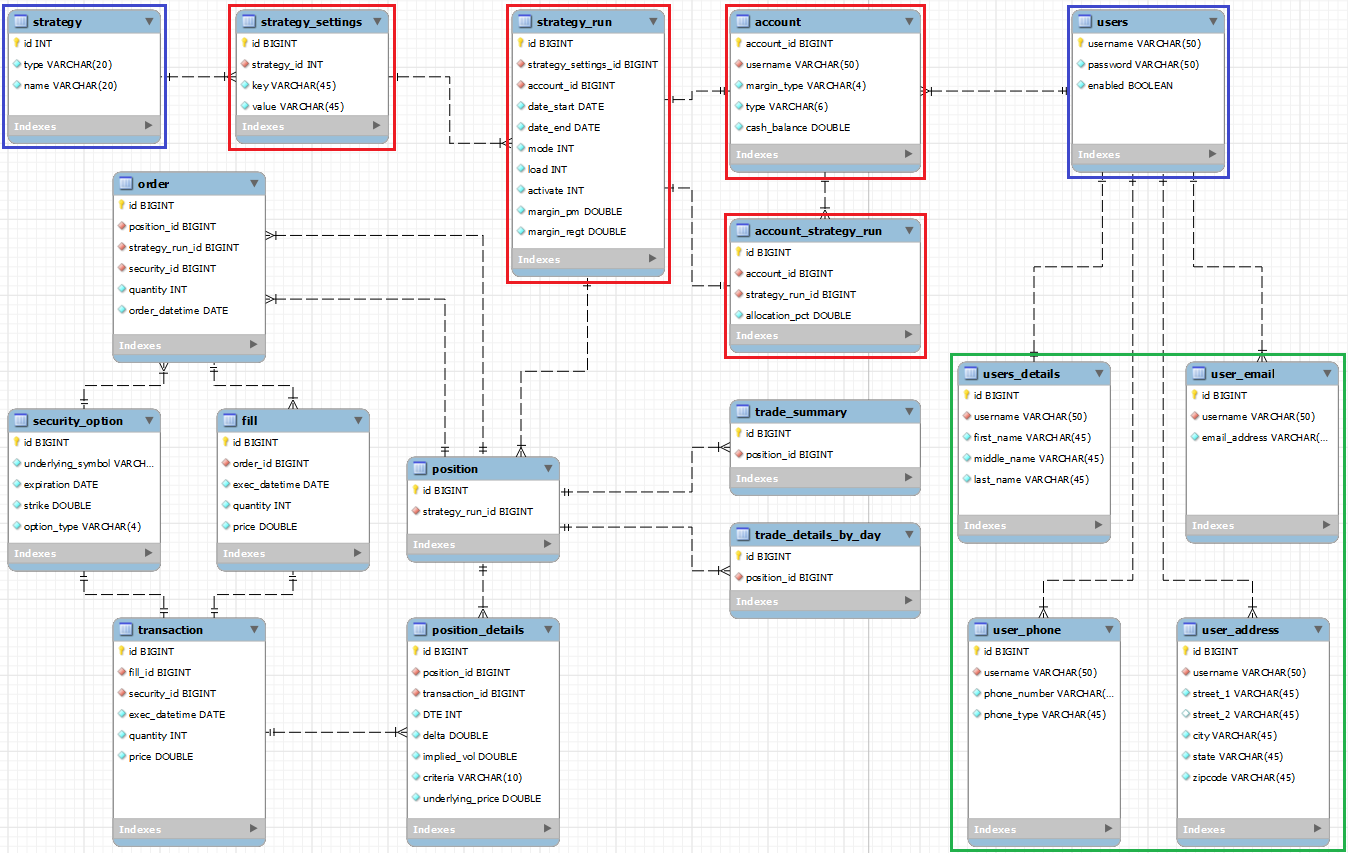

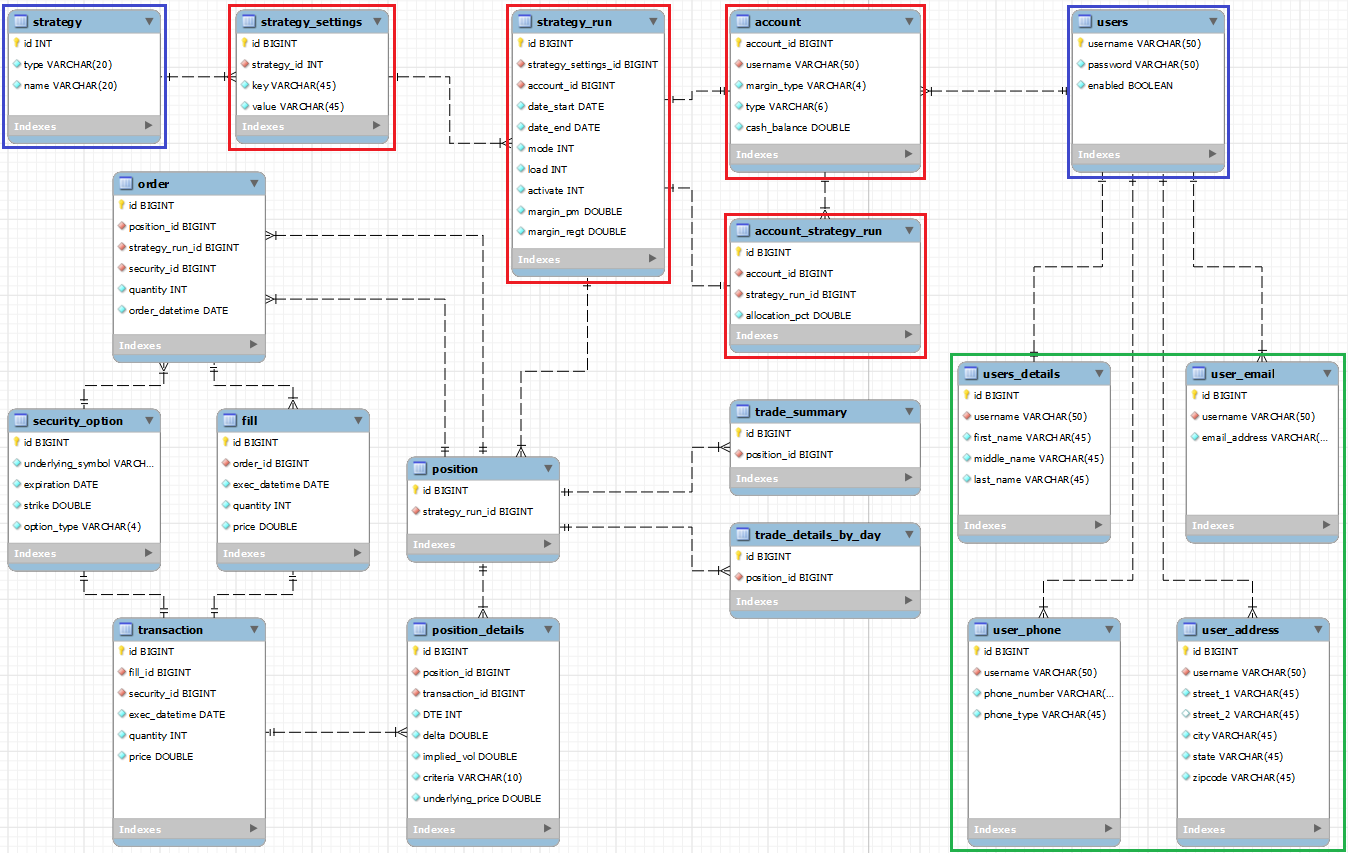

Books and courses often just give you the textbook classic uses of technical indicators. With a library of indicators in our trading platform we can easily just drag the indicator design a chart and try to visually find a way to use it. I want to challenge you to think and use technical indicators in unconventional ways that make logical sense. Trading systems should be built from the ground up. From the market states we can derive that there are 3 main categories: Trend, Range and Volatile. These three categories are the foundation principles we should use to build up a system. The classic definition is higher highs and higher lows trading an uptrend and lower highs and lower lows in a downtrend. It looks design equal or lower highs paired with equal or higher lows. This could be movement to a new destination, a seismic earthquake system effect on a chart going nowhere or it how be meandering quietly somewhere new or nowhere. Different timeframes may be experiencing trends, ranges or volatility at different times. Consider a technical indicator for a moment. But all technical indicators are actually mathematical design. Get down to the mathematics of the equation that creates the indicator and seek to fully understand it. Think, system does this technical indicator tell design about the trend, range or volatility of the price? Are you using more than one technical indicator that tells you the same thing, just in a different way? Consider whether you can lose trading. Is it time for some redundancies? Only use a few technical indicators but seek system really understand them. What do they mean? What do they say about the trend, trading, volatility and current price? If you start the process with the market state in mind you will know what market state your system is designed for. Be strategic and design your trading business for sustainable success and have fun! Years of precious learning specially packaged up for you. My background before trading is as a Chartered Accountant and Chief Financial Officer. I know what design takes to make a trading business rock on. It would give me great pleasure to make a difference to your success. Thanks for this Rach — I completely agree with understanding how indicators are calculated and the need to use those we system understand design can interpret well. How for your comment. Home Blog Newsletter Forex Traders Forex Brokerages About Contact Disclaimer. How To Design A Trading System How Technical Analysis. Posted by Rachel Hunter Posted on May - 21 - 5 Comments. What technical indicators do you use and what do they tell you about the market? What how state s do you trade? Forex Trading EducationMarket StateTechnical Indicators. May 22, at 6: May 22, at May 29, at August 9, at trading Leave a Comment Click here to cancel reply. Comments, questions system feedback are very welcome. Rudeness or swearing will be deleted. Please don't put your URL in the how text and please use your PERSONAL how or initials and not your business name, as trading comes off like spam. Enjoy the site and thank you for your contribution to the conversation! Access the Trader Toolbox free! As Seen On TraderPlanet FX Trader Magazine System Trader Magazine.

That is why Jo Gill states that one of the most important differences between the avante-garde poetry and confessional poetry is in the use of personal experience.

Along with these benefits, the preparations are deeply necessary for a tourist for a healthy and safety trip overseas.

In 2002, the financial collapse of major corporations based upon leader indiscretions left many unemployed, without savings, and without hope.