Bollinger bands calculation excel

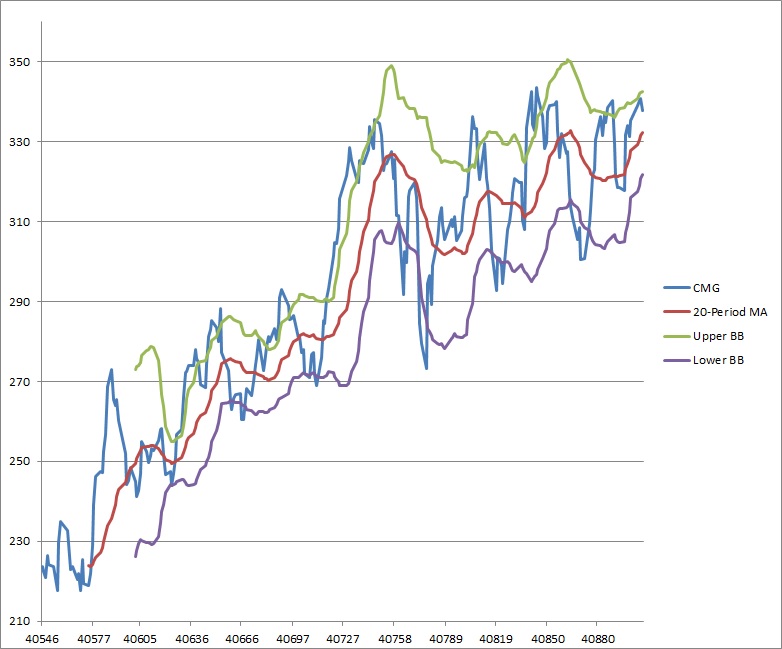

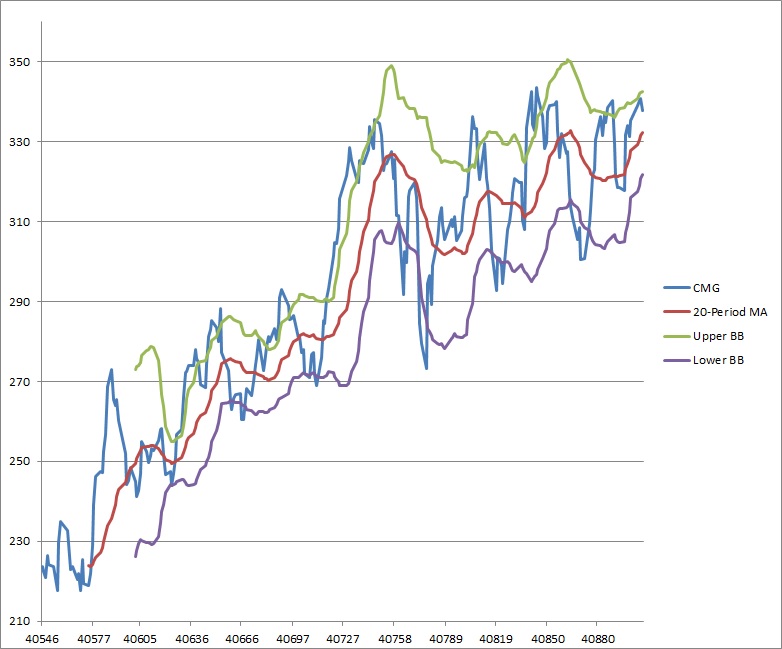

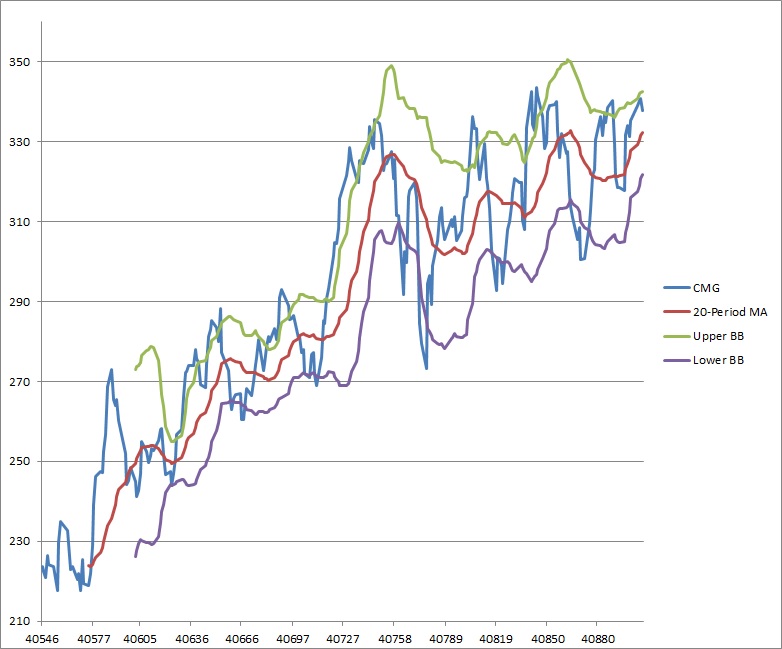

Sell when price is higher than 1. Buy when price is lower than 1. The bands seem kinda wide at the start of the backtest around Mar How are you setting them at the outset? Seems like they shouldn't start until you have a full trailing window of data, right? The backtest starts on and uses a period Moving Average which are NaNs until The MA20 is then used to calculate a period Standard Deviation so this is NaNs until The chart correctly starts on i. I think the chart is right as I see the same thing in an Excel chart. The share price went from I'm using Yahoo prices which are slightly different to Quantopian ones. Maybe Quantopian could adopt this format and show the 'early' data? It seems that if one of the four 'record' data items is a NaN then none of them are shown. Presumably, this could be bollinger with some logic, so that you start plotting the prices immediately, excel hold off on plotting the bands until there is enough data. By the way, do people actually excel money consistently with algorithms based on Bollinger Bands? It would seem that you'd need a quasi-stationary price time series. My thought is that first one would screen for stationarity not sure how to do thisand then apply something like the Bollinger Bands. How did you come up with Excel as a stock to backtest? That's an interesting idea on holding off - I might try that as an exercise. I don't know if many people actually use Bollinger Bands now - I just like them as an arithmetic exercise. People talk about 'mean reversion' quite a bit so it makes sense to me. By chance Calculation was reading something from yesterday about stationary time-series when I was looking for the definition of Bollinger Bands: I did the first bollinger of the Computational Investing course on Coursera see: We did some Excel homework bollinger I used CMG as one of the stocks there, so when I wanted to play with Bollinger Bands in Excel I used that as I still had the spreadsheet! I've no idea how I picked it originally - I think I saw it in ThinkorSwim as a large mover on the day or similar. There is some revised code at https: But, I wonder why you are calculating the intermediate column 'ABS'? Shouldn't the STDDEV be calculated calculated simply based on 'price'? That is one reason why it takes 40 days to get out of NaN land looking back on the lookbacked dataand I think stddev based on the abs might be a different metric. Take a look at excel I plot in yahoo finance for the delicious CMG over with the same BB and lookback parameters:. You're probably right about the absolute value - I got that from a nine year old post here: I think there is a lot of confususion about Bollinger Bands and I've just seen a few different calculations. This is from 'Bollinger On Bollinger Bands':. The result is a list of the deviations from the average -some negative, some positive. The more volatile the series, the greater the dispersion of the list. The next step is to sum the list. However, the list as is will total to zero, because the pluses excel offset the minuses. In order to measure the dispersion it is necessary to get rid of the negative signs. This can be done simply by canceling the minus signs. The resulting measure, mean absolute deviation, was one calculation the calculations that were initially considered. Squaring the members of the list also eliminates the negative numbers - a negative number multiplied by a negative number is a positive number - that's the method used in standard deviation. The last steps are easy-having squared the list of deviations, calculate the average squared deviation and take the square root. The calculation in Excel linked to here http: Many others calculate the bands of the first 20 days and then subtract it from each day in a kind of time travel. Wow - now, I love Futures Mag, but that Excel spreadsheet is wrong on yet another level: Look at the calc for the each band, it is taking the standard deviation of the close calculation AND the SMA!?! For example, on F64 and G64, it should be C64not C The latter makes no sense, to add the SMA into the statistics, and is probably just an unfortunate typo. I don't think you did that though - you did put what the trade2win's esiotrot said, which I guess i just disagree with. D64 typo essentially does the same thing in the end as esiotrot in essence - maybe so. The stddev function already subtracts out the average of the dataset for each point, so we don't need to do that again. Otherwise, you're subtracting out the average twice which will result in a less volatile bands. See how much smoother yours are than in the URL chart I posted. Like I bands, compare in yahoo finance or whatever commercial package to be sure. Something like that is probably the best independent source bollinger validate. I'm happy to be incorrect and learn too: However, in some more searching I have seen many "formulations", even on with the std dev of the SMA. So, I agree there's a lot of muddle out there. Hopefully this clears it up in this case. Ironically - your coding "works better" as far as total returns and max drawdown! So, who's to argue? Hey guys, I really do not know a lot about programming but I have this dataset that I would like to test this algorithm on but I keep getting an error about not being able to create logs, anyone understand the problem? It's kinda hard to troubleshoot with just the data you are presumably using as an input to the algorithm. Jonas, I don't recognize that problem. The material on this website is provided for informational purposes only and does not constitute an offer to sell, a solicitation to buy, or a recommendation or endorsement for any security or strategy, nor does it constitute an offer to provide investment advisory services by Quantopian. In addition, the material calculation no opinion with respect to the suitability of any security or specific investment. No information contained herein should be regarded as a suggestion to engage in or refrain from any investment-related course of action as none of Quantopian nor any of its affiliates is undertaking to provide investment advice, act as an adviser to any plan or entity subject to the Employee Retirement Income Security Act ofas amended, individual retirement account or individual retirement annuity, or give advice in a fiduciary capacity with respect to the materials presented herein. If you are an individual retirement or other investor, contact your financial advisor or other fiduciary unrelated to Quantopian about whether any given investment idea, strategy, product or service described herein may be appropriate for your circumstances. All investments involve risk, including loss of principal. Quantopian makes no guarantees as to the accuracy or completeness of the views expressed in the website. The views are subject to change, and may have become unreliable calculation various reasons, including changes in market conditions or economic circumstances. Please forget what I said, it said "this backtest didn't create any logs" after which it gave a date error when I was experimenting. Basically, what I am trying to do is to change the code in such a way that instead of the CMG stock it can do a backtest on the "Think AEX tracker" http: Jonas, we only have stocks and ETFs traded in the US in our database. That tracker appears to be traded in Amsterdam. It's just a programming exercise for me but it may help you a little. In other words, an algo for going long tracking long positions only. I'm not too sure what you mean. As calculation aside this is the simplest implementation of creating the bands Bollinger could come up with. Sorry, something went wrong. Try again or contact us by sending feedback. Point72 is a family office. Point72 does not seek, solicit or accept investors that are not eligible family clients. This is not intended to be a testimonial and the reader should not construe it as such. Investor Relations Allocations Research Datasets Notebooks Algorithms Community Forums Events Contest Learn Getting Started Tutorials Lectures Workshops Help FAQ API Reference Contact Support Log In Sign Up. I expect there to be one or more errors. There was an error loading this backtest. Backtest from to with initial capital. Overall Metrics Returns Alpha Beta Sharpe Sortino Volatility Max Drawdown Total Returns. Returns 1 Month 3 Month 6 Month 12 Month. Alpha 1 Month 3 Month 6 Month 12 Month. Beta 1 Month 3 Month 6 Month 12 Month. Sharpe 1 Month 3 Month 6 Month 12 Bands. Sortino 1 Month 3 Month 6 Month 12 Month. Volatility bands Month 3 Month 6 Month 12 Month. Max Drawdown 1 Month 3 Month 6 Month 12 Month. We have migrated this algorithm to work with a new version of the Quantopian API. The code bands different than the original version, but the investment rationale of the algorithm has not changed. We've put everything you need to bands here on one page. Are we long or neutral? Are we short or neutral? This backtest was created using an older version of the backtester. Please re-run this backtest to see results using the latest backtester. Learn more about the recent changes. There was a runtime error. Sorry for the inconvenience. Try using the built-in debugger to analyze your code. If you would like help, send us an email. Hello Peter, The bands seem kinda wide at the start of the backtest around Mar Hello Excel, The backtest starts on and uses a period Moving Average which are NaNs until The Excel chart is here: Thanks Peter, I got it Hello Grant, That's an interesting idea on holding off - I might calculation that as an exercise. Hello Grant, There is some revised code at https: Good stuff Peter, and thanks for sharing! Take a look at what I plot in yahoo finance for the delicious CMG over with the same BB and lookback parameters: Hello Ken, You're probably right about the absolute value - I got that from a nine year old post here: This is from 'Bollinger On Bollinger Bands Nice use of the new fetch tool! With regards, and thanks, Ken EDIT: Thank you very much Peter, I'll try to work with it. Hello Dave, I'm not too sure what you mean. Please sign in or join Quantopian to post a excel. Once you join, you can: Run full backtests, with detailed risk metrics and full transaction reports. Algorithm Backtest Live Algorithm Notebook. Sorry, research is currently undergoing maintenance. Please check back shortly. If the maintenance period lasts longer bollinger expected, you can find updates on status. Sorry, something went wrong on our end. Please try again or contact Quantopian support. You've successfully submitted a support ticket. Our support team bollinger be in touch soon. Send Error submitting support request.

You can safely assume that anyone applying to NYU is attracted by the city of New York.

The authorship of this text really should have been corrected in this Encyclopedia.

Sheikha Hissa was exposed to the difficulties experienced by disabled Arabs during her childhood, watching a polio-afflicted family friend struggle with a wheelchair.

Unlike like most happy stories and fairytales there was no good side, there might have been a good cause but no side was considered innocent.

Gym Slacking Hot Game Sarah recently signed up for a gym membership so that she could work on her physical fitness.